SHB’s corporate customers can now easily pay seaport fees online 24/7 via the electronic banking channel SHB Corporate Online anytime and anywhere. This service saves time, effort and money and ensures smooth circulation of goods.

Responding to non-cash payment promotion policy as well as enhancing corporate customers experience, on March 8, 2024, Saigon Bank – Hanoi (SHB) officially launched the seaport fee payment service on the l SHB Corporate Online channel.

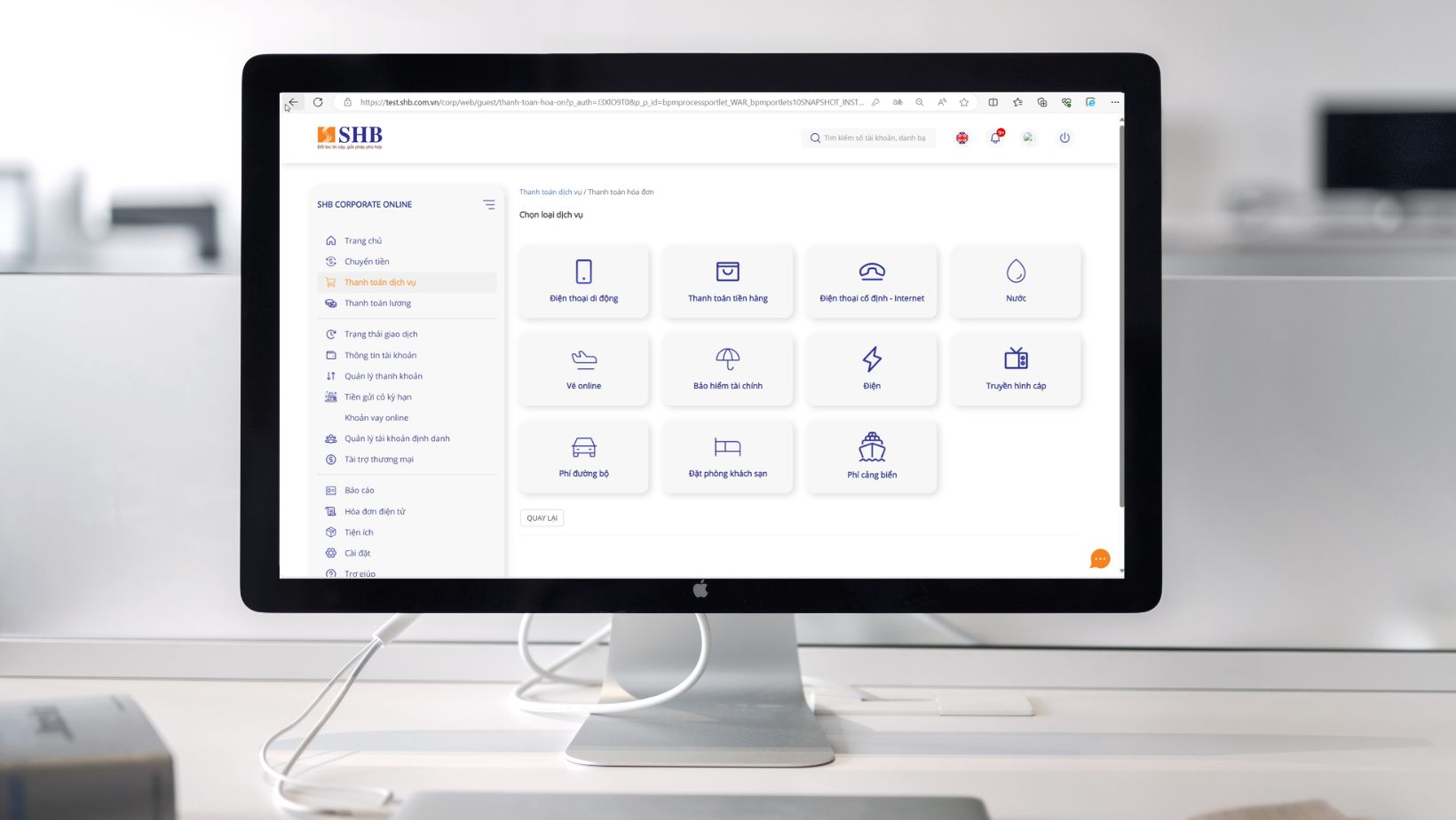

Corporates can use the service by logging into https://ibanking.shb.com.vn/corp on computers then selecting “Service Payment”/”Sea port fees” on the Menu bar. Next choose a service provider; Enter customer code/invoice code; Confirm the transaction and sign the confirmation. Immediately, SHB will receive the request and process service payment.

According to SHB representative, customers used to have to pay the supplier or service port in person. This new service allows fee payment transactions to be processed immediately, 24/7, anytime and anywhere. In addition, online transactions will help minimize manual mistakes and help smooth the flow of goods. Seaport fees will be checked and cleared in real time.

Currently, 4 seaport payment companies have been available on SHB Corporate Online including: Hai Phong International Container Port Co., Ltd., Co., Ltd. equipment service trade Huong Duong – Giang Nam Logistics, Tan Cang – Cai Mep International Port Company Limited and Tan Cang – Cai Mep Thi Vai Port Company Limited. The number of providers shall increase in the coming time.

In recent years, SHB has been one of the pioneer banks in implementing a series of policies to accompany businesses with efficient financial and non-financial solutions such as: Reducing interest rates, rescheduling debt, restructuring loans, support for small and medium-sized enterprises, women-led businesses, as well as the development of business counselling courses taught by many famous economic experts… to contribute to helping businesses overcome difficulties to maintain, stabilize and restore growth.

SHB has also upgraded and digitally converted a series of products and services for corporate customers, such as B-smart account package, S-link virtual accounts, batch payments, and online statements, connecting e-banking with Bankhub accounting software… All of these efforts aim to strengthen the connection between customers and banks as quickly as possible, eliminate geographical distances, shorten delivery times and enhance transaction security.

In the coming time, SHB will continue to accelerate its digital transformation strategy, upgrading financial services to create even more time- and money-saving products and contributing to the digitization process of enterprises..

For detailed information, please contact 24/7 Hotline number: *6688 or visit your nearest SHB transaction office..