The State Bank of Vietnam (SBV) has approved Saigon-Hanoi Bank (HoSE: SHB) to increase its charter capital to VND 40,658 billion through the issuance of stock dividend .

Specifically, SHB has been authorized to issue nearly 403 million shares, equivalent to a stock dividend rate of 11%. This means that shareholders owning 100 shares will receive 11 additional shares. The source of this capital is the bank’s undistributed after-tax profits, fully compliant with legal requirements, along with retained earnings from previous years, as reflected in the audited financial statements dated December 31, 2023.

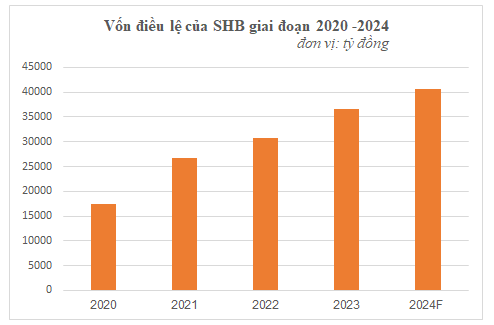

Upon completion, SHB’s charter capital will rise by approximately VND 4,029 billion, from VND 36,630 billion to VND 40,658 billion, cementing its position among the top five largest private banks in Vietnam. This capital increase enhances SHB’s financial capacity, boosts competitiveness amid international economic integration, and aligns with shareholder interests.

According to the 2024 Annual General Meeting of Shareholders (AGM) resolution, SHB will distribute a total 16% dividend for 2023, comprising a 5% cash dividend (paid in August 2024) and an 11% in shares. SHB consistently prioritizes charter capital growth through stock dividend issuance at rates between 10% and 18%, thereby reinforcing its capital base. The bank’s adherence to Basel II and Basel III standards ensures compliance with capital safety and risk management regulations.

Associate Professor Dinh Trong Thinh, a banking and finance expert, emphasized that a robust financial foundation bolsters banks’ market reputation and facilitates capital mobilization from residents, businesses, and bond markets under favorable conditions. Moreover, increased charter capital ensures financial stability and enables digital transformation and green finance across various economic sectors.\

SHB charter capital between 2020-2024. Unit: billion VND

As of December 31, 2024, SHB’s total assets reached VND 740 trillion, with outstanding credit balances nearing VND 523 trillion, reflecting an 18% growth. Prudential, liquidity, and risk management indicators exceeded SBV regulations, and the capital adequacy ratio (CAR) stood at 12%.

In line with its 2024-2028 strategic transformation plan, SHB is advancing innovation, applying cutting-edge technologies, and introducing customer-centric solutions. These efforts have optimized the bank’s cost-to-income ratio (CIR) to 24.68% – the lowest in the industry. With over 95% of processes digitized and 98% of transactions conducted through digital channels, SHB leads the industry in digital transformation. Technologies such as artificial intelligence (AI), big data, machine learning, cloud computing, and biometrics are integral to SHB’s operations.

During this period, SHB is pursuing a transformative strategy focused on four pillars: reforming policies and processes, empowering personnel, following customer-centricity and market needs, and modernizing IT infrastructure. The bank is committed to its six core cultural values: “Heart- Faith – Trustworthiness – Knowledge – Wisdom – Greater Heights.”

SHB aspires to become the most efficient bank, the most popular digital bank, the premier retail bank and

the primary provider of financial services to strategic corporate customers with green supply chain, value chain and ecosystem.

Originating from its core values, SHB remains committed to supporting, creating, and promoting positive contributions to individuals, communities, and society at large, as it joins the nation in embracing a new era of progress.