In the pivotal year of implementing the Transformation Strategy, Saigon-Hanoi Bank (SHB) achieved significant financial success, recording a 25% increase in pre-tax profit to VND 11,543 billion, surpassing the annual target.

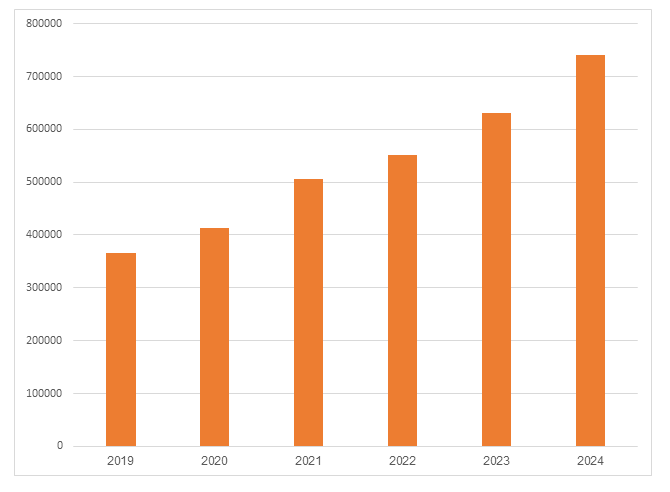

As of the end of 2024, SHB reported exceptional business results, affirming its position among the top five largest private commercial banks in Vietnam and advancing towards regional recognition. The bank’s total assets exceeded VND 747 trillion, marking an 18.5% increase compared to the previous year. Outstanding credit reached nearly VND 534 trillion, with a credit growth rate of 18.2%, aligning with the Government and State Bank of Vietnam’s (SBV) directives to prioritize essential sectors.

SHB has continued to maintain robust risk management practices, ensuring compliance with regulatory requirements. The bank’s capital adequacy ratio (CAR) exceeded 12% in accordance with Basel II standards, while its liquidity risk management adhered to Basel III guidelines. Furthermore, non-performing loans (NPLs) were managed in line with the targets set by the Annual General Meeting of Shareholders (AGM).

During 2024, SHB’s cost-to-income ratio (CIR) stood at 24.5%, one of the lowest in the industry, thanks to the bank’s emphasis on digitalization integration across operations, services, and products. Return on equity (ROE) reached 21.4%, placing the bank among industry leaders.

The bank surpassed multiple targets established by the AGM, including total assets, credit growth, NPLs, and pre-tax profit, reaffirming its confidence and determination to lead in the domestic financial market. This success highlights SHB’s commitment to enhancing management capacity in accordance with international standards and evolving into a modern, regionally competitive financial institution.

The SBV recently approved SHB’s issuance of nearly 403 million stock dividends at an 11% rate, increasing its charter capital to VND 40,658 billion. This development solidifies SHB’s position among Vietnam’s top five private commercial banks. The bank had earlier paid a 5% cash dividend for 2023.

SHB’s solid financial foundation and sustainable growth earned it the 137th spot on the inaugural Fortune SEA 500 rankings, placing 17th among Vietnamese companies by revenue.Additionally, SHB remains one of the top contributors to the State budget.

Total assets from 2019 to 2024

Recognitions and Technological Advancements

In 2024, SHB received numerous accolades from esteemed domestic and international organizations, including being named among Vietnam’s Top 50 most profitable enterprises, Top 10 most prestigious private commercial banks, and recipients of the Vietnam Golden Star Awards.

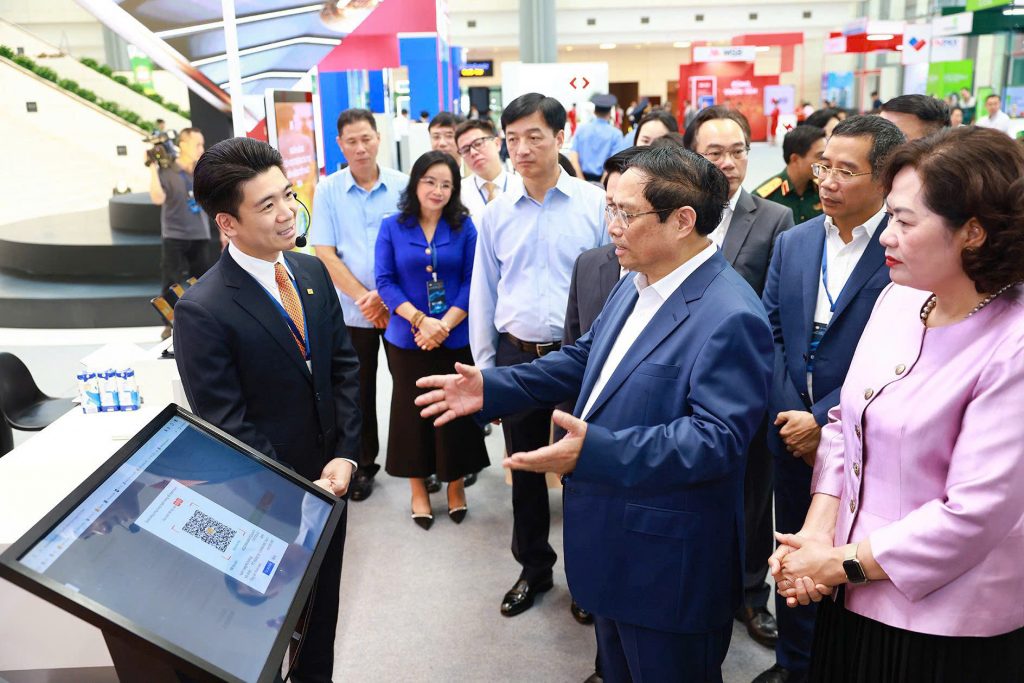

Notably, SHB’s digital services received double honors at the Digital CX Awards 2024: the ‘Collection Service via SLINK Virtual Account’ won ‘Outstanding Digital CX – Cash Management Platform,’ and the ‘ACAS Automatic Credit Approval System’ earned ‘Best Technology Implementation for Digital CX’. Both solutions, developed in-house, underscore SHB’s commitment to digital transformation and the integration of advanced technologies such as artificial intelligence (AI), big data, machine learning, cloud computing, and biometrics.

Currently, over 95% of SHB’s operations are fully digitalized, and more than 98% of individual and corporate transactions are conducted through mobile and internet banking channels. These advancements position SHB as a digital banking leader within the industry.

Social Responsibility and Sustainable Development

SHB remains committed to sustainable development and social responsibility. Responding to the Prime Minister’s call for social support, the bank donated VND 100 billion to Soc Trang province to construct and repair houses for underprivileged families. Additionally, as part of its disaster relief efforts, SHB and the Ministry of Public Security have provided housing assistance in Son La province and other regions, including Tuyen Quang, Dien Bien, Yen Bai, Ha Giang, and Thai Nguyen.

Across the S-shaped strip of Vietnam, SHB has made its mark everywhere—from the highlands to the nation’s frontiers—building new schools, including two projects worth over VND 12.5 billion in Dien Bien’s highland communes, and supporting disadvantaged households across provinces and cities.

Following Typhoon Yagi, SHB promptly engaged in relief activities, visiting affected areas and implementing financial policies to support recovery efforts for individuals and businesses.

Recognized for its social contributions, SHB was honored as the “People’s Bank of the Year” acknowledging its commitment to creating lasting value for the community.

Strategic Vision for 2024-2028

SHB is embarking on a comprehensive transformation strategy for the period 2024-2028, focusing on four pillars: reforming mechanisms, policies, and processes; prioritizing people-centricity; emphasizing customer-centricity; and modernizing information technology through digital transformation. These initiatives are grounded in SHB’s core cultural values: Heart, Faith, Trustworthiness, Knowledge, Wisdom, and aspiration for Greater Heights.

The bank aims to become the most efficient bank, the most popular digital bank , the premier retail bank and the primary provider of financial services to strategic corporate customers with a green supply chain, value chain and ecosystem.

With a clear and differentiated strategy, strong foundation, and deep-rooted cultural values, SHB is poised for a period of robust and comprehensive transformation, contributing to Vietnam’s economic growth and prosperity.